What Goes Into A Stock Price? Thoughts Post SVB's Bank Failure

May 06, 2023This post may be more useful after reading SVB’s bank collapse post for context (blog posted 4/1/23). It’s interesting to see when one company’s stock falls to drag down an entire sector. In this type of instance, either the market completely missed something and has to rerate all the stocks in a sector or there’s potentially a buying opportunity.

As Silicon Valley Bank depositors withdrew money, SVB’s stock price dropped…

Other banks such as the 24 banks (Bank of America, JP Morgan, PNC Financial, etc) that make up the KBW bank index all saw their share prices drop.

The question is… is this warranted?

SVB saw a classic bank run as over 87% of SVB’s deposits were FDIC uninsured (i.e. amounts over $250,000) and depositors were pulling out money. Other regional banks with high FDIC uninsured deposits may see something similar. Furthermore, there’s an argument to be made that this is the death of regional banks. Why take the chance and put your money in a regional bank given the risk of a bank run? The US government can’t possibly let the big banks fail so shouldn’t you keep your money in a large bank for safety? Therefore, for banks such as JP Morgan or Bank of America that are deemed “too big to fail”, should their stock prices drop too?

The answer may not be so black and white. To truly understand the answer, one should study how much the stock price has dropped for each bank to understand what the market is implying. Clearly the “safer” banks had a less severe drop in stock price. If there’s no bank run risk, shouldn’t their stock price not drop at all?

For regional banks, obviously not all of them will experience a bank run. So then what is the market suggesting with their decreased stock prices? The drop in stock price likely reflects 1. some losses due to selling some available-for-sale securities at a mark-to-market loss to satisfy customer withdrawals and 2. assets locked in lower rates so the company “underearns.”

What about the predominately large banks such as JP Morgan and Bank of America? Should their stock prices bounce back to levels before SVB’s bank run? These large banks are designated as global systemically important banks (“GSIBs”) or “too big to fail”. If these banks were to fail, then the entire banking system may go down. There would be no more trust in the global banking system. People would pull all their money out and place it elsewhere (notice the increase in bitcoin price during this period as people believe it to be a potential storage of value).

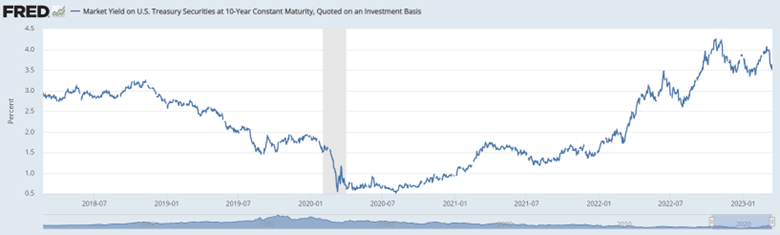

Another important thing to note for banks during this period is the extremely low (near zero) interest rate for deposits. Interest rates rose to where short-term treasuries are yielding ~5%.

Why keep cash in banks yielding 0% when short-term US guaranteed treasury bills yield 5%? This phenomenon of cash moving out of checking accounts into treasuries is called cash sorting. As interest rates rise, deposits decrease, limiting the potential asset base banks can lend out, therefore decreasing their net interest revenue. Banks will have to either increase deposit interest rates or face additional withdrawals over time. The current drop in stock prices perhaps finally reflect the overearnings of banks (net interest margin is above historical averages).

Conclusion

The conclusion here is that analyzing a stock price is not as simple as looking into one factor. Assume you long a stock and the stock goes up, that doesn’t mean you correctly understood why the stock went up. When all the bank stocks dropped due to SVB’s bank run, there were various reasons for decreased bank stock prices: 1. Risk of a bank run 2. Lower returns - Assets locked into low yielding instruments with long duration 3. Some mark-to-market losses for liquidity 4. Higher interest rates equate to lower valuations. In other words, these stock prices reflect a spectrum of risks and of varying degrees all into one price.

I personally do believe some banks do not deserve the severity of how much their stock prices have dropped. The market is clearly pricing in a greater than zero chance of bank failure more than dilutive capital raises or decreasing net interest revenues. There have been several potential buying opportunities...

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.