Why Did Silicon Valley Bank Fail?

Apr 01, 2023What happened to Silicon Valley Bank? Summary below!

Question: Why does the Silicon Valley Bank failure matter?

Answer: It is the second largest bank failure in US banking history based on deposits (by assets its #3 behind First Republic that filed two months later)

As of SVB’s bankruptcy filing

SVB Situational Overview

SVB bank was founded in 1983 and was banker to ~50% of all venture capital-funded technology and life sciences companies in the US.

In 2021, SVB saw a massive inflow of deposits. Interest rates were low, venture capital investment activity fueled client liquidity, driving exceptional balance sheet growth for SVB.

Banks make money by taking in deposits and lending out that cash in the form of loans. Cash is lent at higher interest rates than deposit interest rates to earn a “spread” or net interest income. As SVB’s deposits grew, the bank purchased vast amounts of mortgage-backed securities for its hold-to-maturity portfolio. 97% of these MBS were 10+ years in duration with a weighted average yield of 1.56%. This created a larger duration mismatch – the deposits were liquid and short term while the assets were illiquid and long term. Liquid deposits were loaned out at a 10+ year duration.

What all this means in simple terms is that in a low interest rate environment, they bought low interest rate assets that have long maturities. They did this because longer maturity instruments generally have higher interest rates than shorter maturity instruments. In theory, there should be no issues if it’s business as usual. SVB presumed the economy was strong, deposits will stay with the bank, and there would be no need to sell significant amounts of assets. What they did not foresee was a future increase in interest rates…

Rising Rates

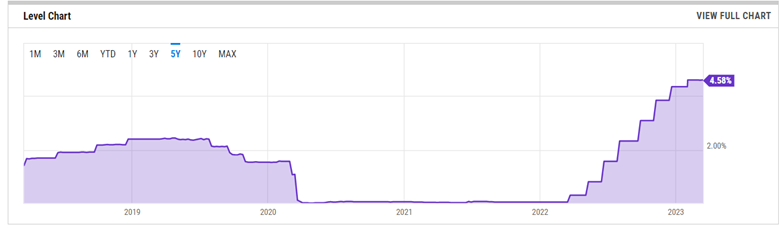

As inflation proved to be stick (rising 6.5% for 2022), the fed started raising interest rates. Notice the significant jump in interest rates in 2021-2023 YTD below.

Federal Funds Rate

As interest rates rose, the market value of SVB’s assets dropped (interest rates and bond prices have an inverse relationship). Its bond-like instruments are worth less on a mark-to-market basis. This is because financial instruments that have a lower interest rate should trade at a discount to those with a higher interest rate, all else equal.

To be clear, SVB would only lose money if it were to sell any assets prematurely. If SVB can hold the portfolio of assets to maturity, SVB would earn the yield on its portfolio without any mark-to-market losses.

As the macroeconomic conditions worsen for banks (most banks have mark-to-market losses in this scenario described above), several factors make this especially problematic for SVB.

Customers deposits at banks are FDIC insured up to $250,000. For SVB, $151.5bn out of $173.1bn of its deposits at year end 2022 were uninsured (i.e. deposits above $250,000). SVB catered to technology companies rather than traditional retail customers therefore having very skewed uninsured deposits.

The Unraveling

As technology startups stopped growing and VC funding dried up, some of these companies started to withdraw cash to pay salaries, rents, etc. Deposit balances started to decrease.

As these companies withdrew cash, SVB had to sell its available-for-sale securities at market value in order to pay for customer withdrawals.

On March 8th, SVB sold $21bn of US treasury and agency securities and realized a $1.8bn after-tax loss as a result of the sale. The bank was also working with Goldman Sachs to raise $2.25bn through an equity offering for additional liquidity.

On March 9th, depositors and investors tried to pull $42bn billion from SVB! This was a classic run on the bank. If your deposits are not insured, you are an unsecured creditor to the bank. Last person out loses in this death spiral!

The FDIC regulators took over SVB on Friday March 10th 2023. All depositors were eventually guaranteed. But for shareholders and debtholders, their value will eventually be wiped to zero. SVB Financial Group, the parent company of Silicon Valley bank, filed for bankruptcy on Friday March 17th.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.